Table of Contents

By Paul Dellios – Principal, Dellios, West & Co.

Barristers, Solicitors, Business & Investment Consultants

When a person with assets (excluding jointly owned ones) passes away, a personal legal representative must be approved by the Probate Office to administer the estate.

If there is a Will, the Executors must apply for Probate. If there is no Will, the deceased’s next of kin must apply for Letters of Administration. These applications, submitted to the Supreme Court’s Probate Office, can be complex and time-consuming, often requiring the assistance of a solicitor.

Once a Grant of Probate or Letters of Administration is obtained, the representative can distribute the assets according to the Will or, if there is none, according to the legal framework for intestacy. The process can take several months and may also involve filing tax returns for both the deceased and the deceased estate, including normal income tax and potential capital gains tax obligations.

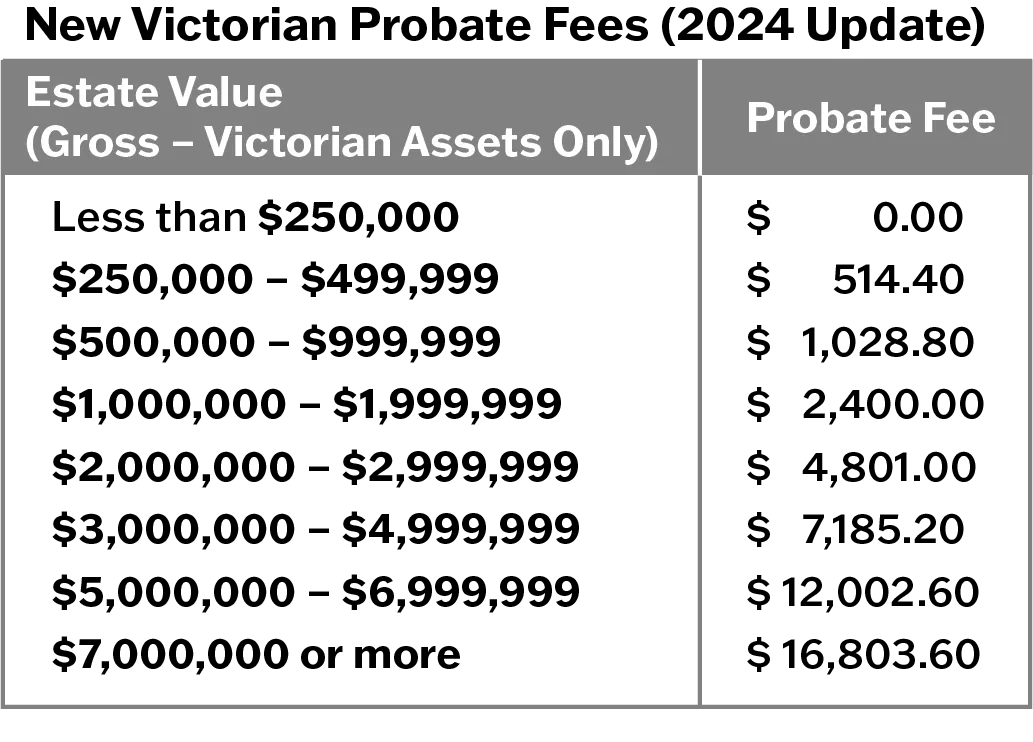

While Australia abolished death taxes decades ago, government fees still apply for Probate applications and asset transfers. Historically, the Probate Office charged a flat fee—for example, $320 in 2017, regardless of estate value. However, since 2018, fees have been scaled based on the estate’s value.

As of 18 November 2024, Victorian Probate fees have increased significantly. Estates valued at less than $250,000 incur no fee, but for those worth $7 million or more, the fee is now $16,803.60 (see table below). These fees must be paid when lodging an application, regardless of the deceased’s date of death. Typically, they are covered by the Executor or next of kin and later reimbursed from the estate along with other incurred expenses.

These changes mean that death in Victoria has become significantly more expensive for many families.